GST payment

306 if you have no children 387if you have one child 467 if you have two children 548 if you have three. In simple terms a debit note comes into the picture when the taxable value tax charged in the tax invoice is less as compared to the actual.

Make Online And Offline Gst Payments Post Login

There are 2 exceptions to this date.

. 14 hours agoThe maximum payment you could receive if you are married or have a common law partner. Goods and Services Tax. IRAS will pay interest on tax refunds made after 30 days from the date the.

Your GST reporting and payment cycle will be one of the following. Calculating GST Payment Due. For example a single individual who typically gets 467 spread across four quarters July October January and April will now receive 70050 in total ie.

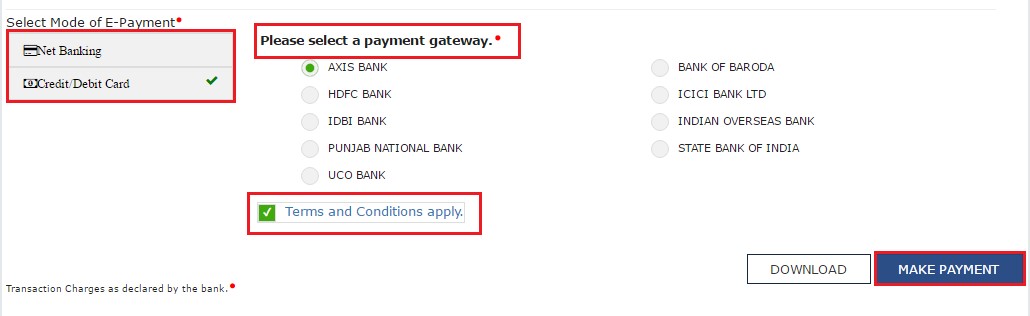

Typically GSTHST credit payments are made on the fifth day on or before of July October January and April. Make your GST payment in this step via netbanking or debitcredit card as chosen by you. For Calculating GST Payment Due Electronic Liability Ledger should be used.

Your goods will be released automatically when they arrive in Jersey although you wont benefit from the de minimus you must pay GST on imports with a value less than 135. For those who need it most inflation relief will soon be on the way to help with the cost of groceries and other essentials. If you are single 234 no children 387 with 1 child 467 with 2 children 548 with 3 children 628 with 4 children If you are married or have a common-law partner 306 no children 387 with 1 child 467 with 2 children 548 with 3 children 628 with 4 children.

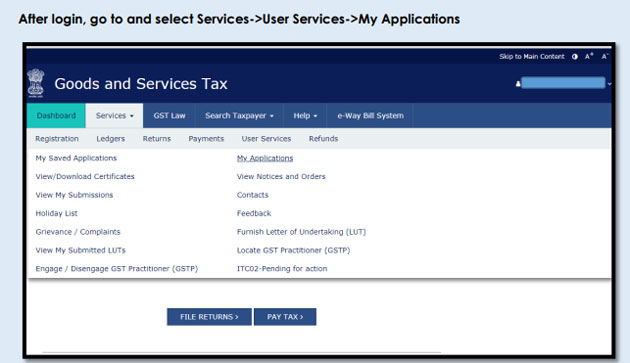

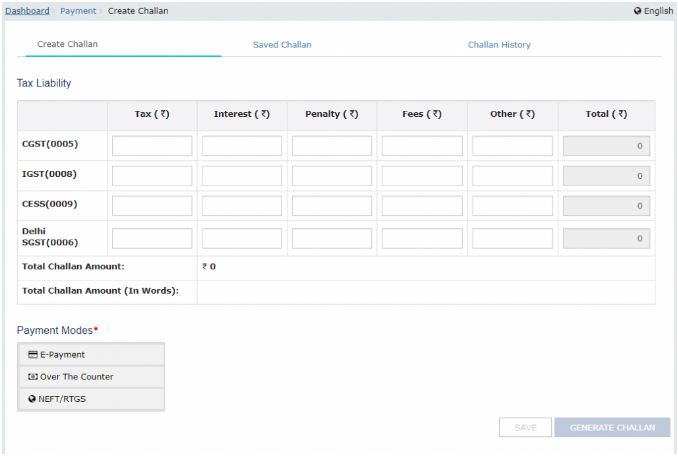

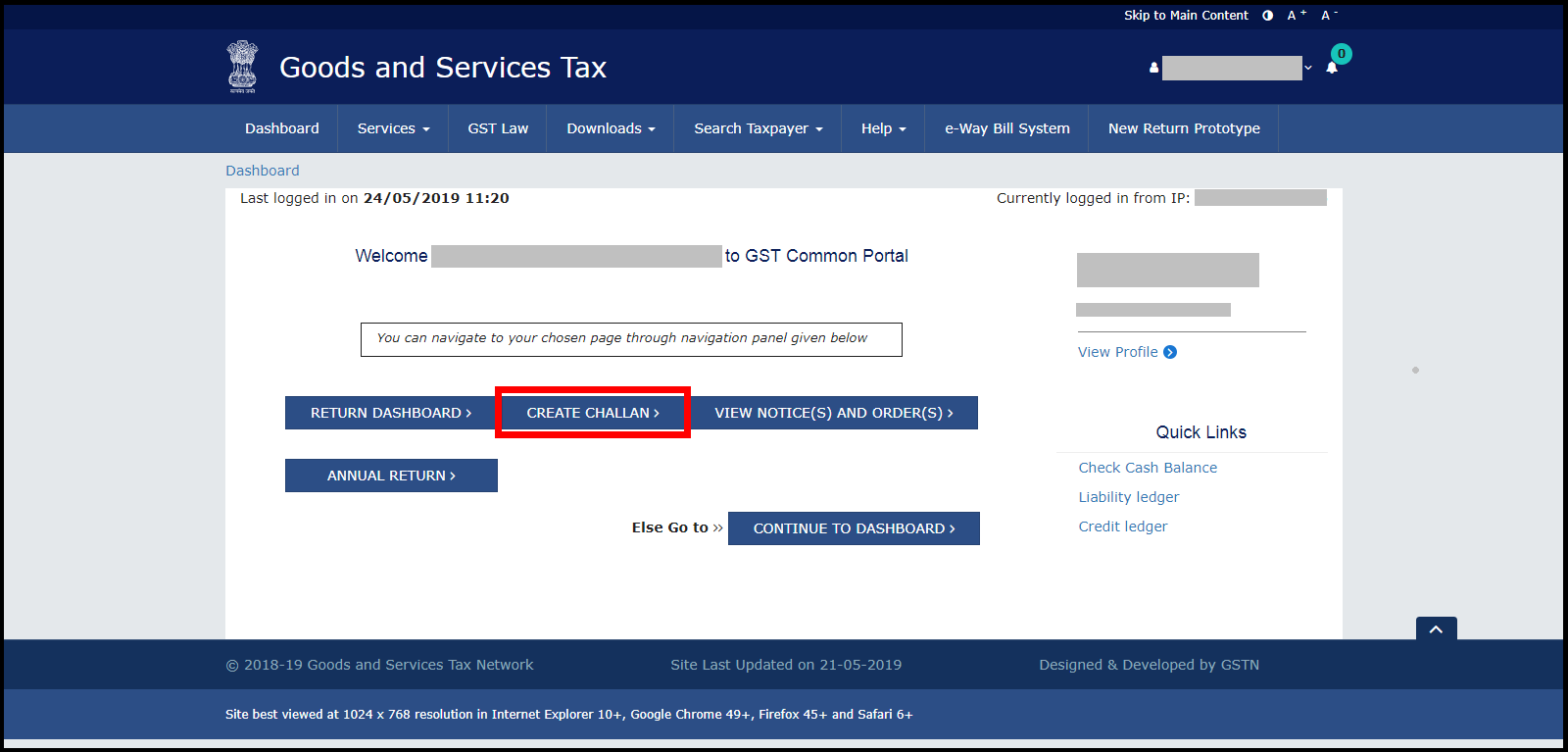

First step- login to the GST portal The second step- go to the Services menu PaymentsCreate challan or direct create challan from the option available in GSTR-3b return filing after option proceed to payment. Annually if you are voluntarily registered for GST. For the 2021 base year payment period is between July 2022 June 2023.

What are the simple steps for GST payment online. What is Debit note under GST. 1 day agoDoubling the GST Credit for Six Months.

Is the GST doubling in 2022. According to Trudeau for the next six months Canadians will be seeing some relief when it comes to paying the bills. Grievance against PaymentGST PMT-07.

Payments will be issued automatically starting November 4 2022. Quarterly if your GST turnover is less than 20 million and we have not told you that you must report monthly. Your payment will be mailed to you or deposited into your bank account if youre signed-up for direct deposit.

In 2022 the payment dates are as follows and are based on your 2020 return. On the GST portal go to the Services option. You could receive a maximum payment of up to.

The goods and services taxharmonized sales tax GSTHST credit is a tax-free quarterly payment that helps. Debit note as defined under section 2 38 of the Central Goods and Services Tax Act 2017 means a document issued by a registered person under section 34 3. 2 days agoThe Prime Minister of Canada took to Twitter on Monday to make an announcement that will affect 11 million households.

You will get this payment if you were entitled to receive the GST credit in October 2022. Monthly if your GST turnover is 20 million or more. Customs declaration and payment website CAESAR.

After choosing your GST online payment mode click on Make Payment. Yes the government plans to double the GST credit payment in 2022. That is you are registered for GST.

Generally tax credits of at least 15 are automatically refunded. From Payments option below it select Create Challan. Taxable period ending 31 March is due 7 May.

It may go without saying but pretty much all qualifying applicants for the GST credit. Allow up to 10 working days before you contact CRA if you havent yet received your benefit on the GSTHST due dates. My business is not GST-registered but is Customs-approved.

Tax refunds made via cheques may take up to 30 days. 234 for a single person 306 for married or common-law partners 387 for a single parent with one child 467 for a couple with two children Individuals who currently get their GST credit. In the coming weeks an estimated 11 million low- and modest-income people and families will receive an additional Goods and Services Tax GST Credit payment.

Note that July 2022 to June 2023 payment will be the start of a new calendar year for GST payments and it will be based on your 2021 tax returns. You must pay Customs within 30 days using CAESAR. For example the taxable period ending 31 May is due 28 June.

Your GST payment is due on the same day as your GST return. And in 2023 the payment dates will be as follows and are based on your 2021 return. Click on View Receipt to view the GST payment you just made.

Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the date of the tax credit arises. Now provide a GSTINother ID and click on Proceed. Once you provide the GSTIN you will be asked to enter the Captcha code in the next column.

Every month on the 20th GSTR-3 or the monthly return is due. After filing GSTR-3 the GST Monthly Return the GST payment required in any given month can be easily seen on the GST Common Platform dashboard. Taxable period ending 30 November is due 15 January.

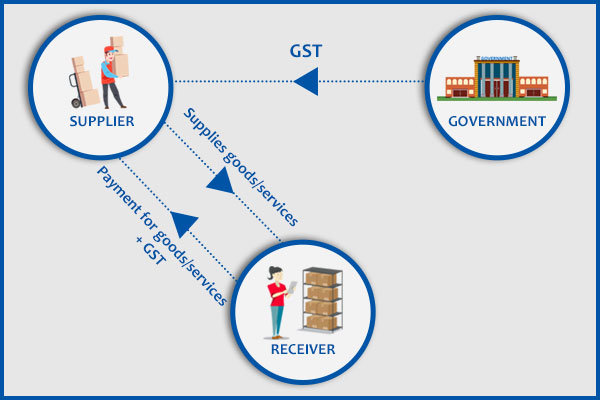

Goods Services Tax GST Payment. Please make sure to read terms and conditions before going ahead with GST payment online. This is the 28th of the month after the end of your taxable period.

The GST credit boost will result in recipients receiving a 50 increase on their GST payment benefits for the 2022-2023 year. How much you can expect to receive 5. 612year total for both.

Working Out Your Gst Return Gst Bas Guide Xero Au

Gst Need To Make Additional Gst Payment Here S How To Go About It

Gst Payment Dates 2022 2023 Gst Double Payment Explained

Gst Challan Payment Process To Pay Gst Online Learn By Quicko

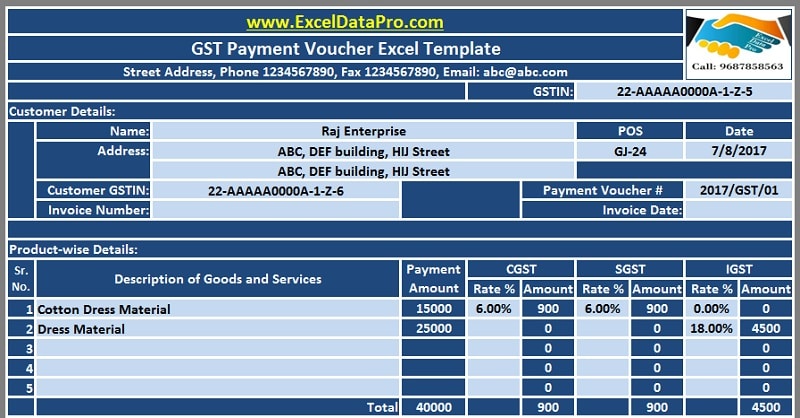

Download Gst Payment Voucher Excel Template For Payments Under Reverse Charge Exceldatapro

Gst Pay Online Payment Internet Banking Neft Rtgs Debit Card Credit Card And Bank

How To Pay Your Monthly Gst Liability Form Gst Pmt 06

Gst Payment Status And Payment Failures Masters India

How To Pay Gst Online Gst Payment Process Rules Form

List Of Gst Payment Forms Types Of Gst Payment Gst Portal India

Pay Gst In Installment And On The Basis Of Receipts Instead Of Invoices

Cbic Issues Instructions For Payment Of Tax During Gst Search Inspection

Steps For Gst Payment Challan Through Gst Portal

Make Online And Offline Gst Payments Post Login

Officials To Recover 46 000 Crores As Late Gst Payment Interest Hostbooks

Gst Online Payment How To Pay Gst Online

How To Pay Gst Online Taxaj